- HOW TO CODE PERSONAL EXPENSES IN QUICKBOOKS HOW TO

- HOW TO CODE PERSONAL EXPENSES IN QUICKBOOKS FOR MAC

- HOW TO CODE PERSONAL EXPENSES IN QUICKBOOKS GENERATOR

- HOW TO CODE PERSONAL EXPENSES IN QUICKBOOKS FULL

- HOW TO CODE PERSONAL EXPENSES IN QUICKBOOKS SOFTWARE

It has tools for creating estimates, a time tracker for when you are working on a job, and an invoice generator to submit payment requests. This program can be accessed both from your desktop and your mobile phone. If you work as a freelancer or a contractor, we recommend FreeAgent. Plus Quicken integrates with financial institutions and will give you an overview, or in-depth accounting of your expenses, investment portfolios, and account balances. You won't be bogged down by tools you don't need, but will still have access to budget sheets. At the top of the report, click the down arrow for Report period and select Custom. Look for your Income or Expense account and click Run report under the Actions column. 9 Votes) Go to the Chart of Accounts tab. There are tools for tracking expenses, and if you take a picture of your receipts, QuickBooks will save them in the appropriate files, plus pull information from the receipts and auto-populate expense tracking sheets, budgets, and tax forms.įor personal accounting purposes, you can find everything you need in Quicken Deluxe for Mac. Category: personal finance personal taxes.

HOW TO CODE PERSONAL EXPENSES IN QUICKBOOKS SOFTWARE

It has tools for both business and personal expense tracking, integrates with tax software and services, and formats payroll so you can either pay it yourself or send it onto a payroll service. The best accounting software is QuickBooks. The same tax tools are available for personal income tax purposes, so filing returns each year are more smooth. If you connect your credit cards and bank accounts it will automatically deduce transactions and add income, and give you an overview of where you tend to spend your money and help you rein in unhealthy financial habits. On the personal side, QuickBooks walks you through the steps for setting up a budget. QuickBooks for personal Finance involves the management of different aspects of your personal home finances using QuickBooks. You can easily keep track of your expenses, income, and budget all in one place. Simply put, QuickBooks helps you run your home on the go. Check out this list of the best tax preparation software to learn more about these programs and how they connect to QuickBooks for Mac. Utilizing QuickBooks for Personal Use and Money Management will streamline your Home Affairs right from Online Banking to managing Budgets. You can also send this information to a physical tax preparer from within the QuickBooks program. In fact, QuickBooks imports information to tax programs to make completing forms and paying taxes easier and more accurate. Transactions are automatically tagged, sorted, and filed so they're ready for tax time. This Mac accounting program makes it easy to run payroll from right within the program, or you can send properly formated data to a payroll service so turn around from submitting to payout is quick.

HOW TO CODE PERSONAL EXPENSES IN QUICKBOOKS FULL

It also integrates with your financial accounts including credit cards and bank accounts and gives you a full overview of your income and expenses without requiring much input from you. It syncs with programs like PayPal and Square, and with POS machines and app to make it easier to account for business income.

HOW TO CODE PERSONAL EXPENSES IN QUICKBOOKS FOR MAC

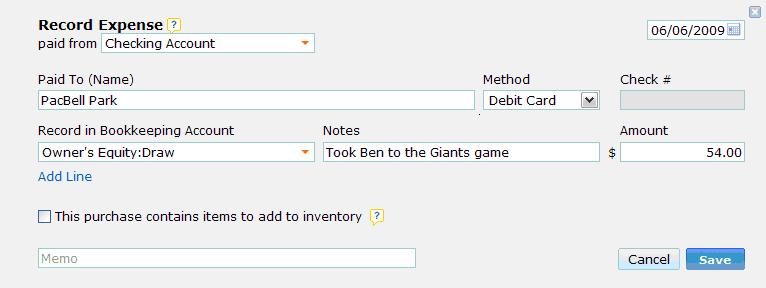

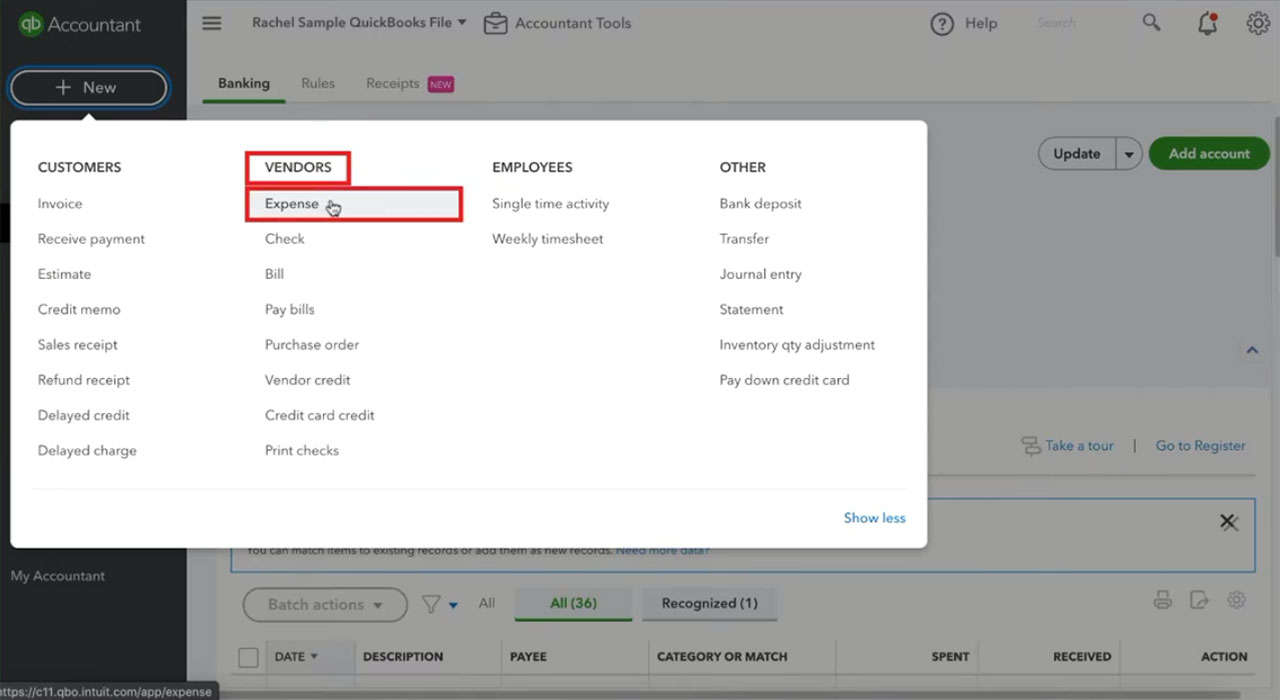

Select the Payment Method and enter the reimbursement amount.QuickBooks for Mac keeps both personal and business needs in mind and gives you tools to keep on top of expenses and income.Even if they're not a customer, this is the best option. To record IRA contributions in Quickbooks is a basic seven-step process depending on personal circumstances. You can refer to the process here and even here for a more in-depth description of the process.

HOW TO CODE PERSONAL EXPENSES IN QUICKBOOKS HOW TO

Learning how to record IRA contributions in Quickbooks is a rather straightforward process. Tip: Add the person as a customer if they aren't in your books already. How to Record IRA Contributions in Quickbooks.

In the Received From field, enter the person who made the personal expense, then select the account.

0 kommentar(er)

0 kommentar(er)